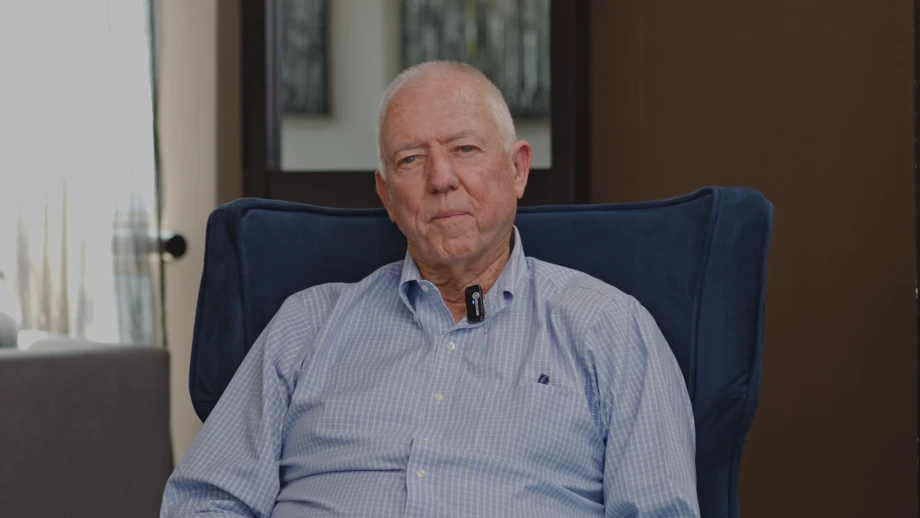

Kachiza Kwenda is the CEO of Prudential Life Assurance Zambia, the local arm of the global financial services giant of the same name. Globally, Prudential has been around for 174 years and has been part of the most iconic moments in human history. Most notably, Prudential covered many lives that perished on the Titanic on 14th April 1912. By June 1912, Prudential had paid out claims for 324 lives. Prudential also covered the lives of thousands of people from World War I and World War II, which were traced up to 30 years after the end of the world wars. Today, Kachiza Kwenda is part of the team building on the legacy created by Prudential and taking it forward.

I sat down with Kachiza at The Retreat, a restaurant nestled inside Roma Park, a mixed-use development located in the heart of Lusaka. The Retreat offers a family-friendly atmosphere paired with a world-class dining experience to serve both young and old. This was the perfect backdrop for a conversation on work, life, and everything in between.

Kachiza is one of the youngest CEOs in the Zambian financial services industry. In his mid-30s, he is leading a team of 180 staff and 2,000 agents on a mission to deliver the best insurance service to the dynamic Zambian customer base.

The path to the insurance industry was mapped out from the start. Kachiza’s father worked in insurance and his mother was a teacher. His parents gave him and his brothers a blueprint to follow. Growing up, the boys had the option of either working at the family farm or the family business, which ultimately gave them a head start in preparing for their professional lives. Today, most of Kachiza’s brothers work in the financial services sector.

Kachiza credits his success to his upbringing. “Growing up, we were provided with both physical and psychological safety. We were given serious boosts of confidence. We were always told that we could go out there and make mistakes, that we were not better than anybody and that nobody was better than us,” Kachiza comments.

“I was privileged to have worked in our family business and I got insights around things that perhaps other people didn’t…I learned that relationships are worth more than money. I interacted with shareholders and saw that money doesn’t grow on trees.”

Before becoming CEO, Kachiza held several leadership roles at the company with the last one being the CFO at Prudential for almost three years. The skills he acquired during his time as CFO were pivotal to his rising to the CEO role. Today’s CFO has transitioned from being a number cruncher to a strategist, one able to use numbers to tell a bigger forward-looking story and help steer a company towards success. The transition from CFO to CEO was relatively smooth because the skills were transferable. Kachiza inherited the role with a clear picture of the business. However, this didn’t mean he could relax, there was still work to be done.

Success in the role of CEO requires an equal measure of technical aptitude and personal awareness. Kachiza sees CEOs as “leaders of leaders” and believes they must be aware of their traits and those of others. Reflecting on his journey, Kachiza credits quick learning and adaptability as keys to his success. “I believe life is a game and every game has rules. I know where I should be and where I shouldn’t be. I understand myself fairly well and I know what my limitations are. I have very good people on the team who complement my weaknesses and strengths that have helped me in my transition thus far.”

Kachiza also credits his success to early exposure to the insurance industry through his family’s business. Commenting on this exposure he says, “I was privileged to have worked in my father’s business and I got insights around things that perhaps other people didn’t. Things that are best learned from experience rather than books, such as negotiating, networking and selling. I learned that relationships are worth more than money. I interacted with shareholders and saw that money doesn’t grow on trees. These are experiences that are difficult to replicate. I was inoculated with confidence from a young age. I was taught to be respectful of people but also to never be afraid to question things.”

Despite his early success, Kachiza continues to learn and improve. He is a firm believer in neuroplasticity, which posits that every experience alters the brain’s organisation at some level. Neuroplasticity refers to the lifelong capacity of the brain to change and rewire itself in response to the stimulation from everything we learn and encounter. Kachiza shared a story of a girl who had half her brain removed and lives a normal life today. This story inspires him to keep learning and developing his skills.

To challenge himself and overcome his fears, he recently learned how to swim and even how to juggle. This provides a glimpse into Kachiza’s mindset, never settling and always looking for a challenge. “Success for me is in the incremental gains. Some people believe in Big Bang events but I believe in doing the little things a little better. I also believe the finish line for success is always moving so that keeps me excited to keep exploring.”

On his leadership style, Kachiza sums it up in six words, “loose on people, tight on objectives.” He believes in getting the best people for the job and then letting them get on with their work. “I don’t have all the answers. I depend on experts to do their job and it’s my job to make sure the environment is enabling. I believe everyone brings something to the table. You don’t evaluate a fish based on its ability to climb a tree.”

“I depend on experts to do their job and it’s my job to make sure the environment is enabling. I believe everyone brings something to the table.”

The culture at Prudential is one of innovation and responsiveness. During the COVID-19 pandemic, the insurer cemented itself in the minds of its customers by tailoring its offerings to meet pressing needs. Prudential waived off all pandemic clauses in its policy, paid out millions of kwacha in claims and even covered frontline public health sector workers for free. COVID coverage was also extended to all existing customers. As people question whether they should keep paying for insurance in the face of rising inflation, Prudential continues to prove itself to be a valuable partner to the everyday Zambian.

Kachiza’s story as the CEO of Prudential is still in its early stages and he still has a long career ahead of him. However, career progression is not the only thing he values in life. He is a husband and father to two young boys who keep him on his toes. He has other interests outside of work such as gardening, cycling and, more recently, swimming. He also enjoys learning, especially trivia or what he describes as “random things that no one cares about.” Did you know that a crocodile cannot stick out its tongue? This is just one random thing I learned from Kachiza during our chat. He is just as inquisitive now as when he was a young boy learning about the world of insurance from his father.

Kachiza believes that if he hadn’t followed his current career path he would have been a farmer, which is not surprising given his exposure to the family farm from a young age. Our discussion concludes with Kachiza telling me, “I am convinced without a doubt that wherever I go, I definitely won’t be subpar. I am highly adaptable. I don’t obsess about what I will do next, sufficient is the challenge for the day. Tomorrow will worry for itself and I pray for strength for what I have today.”

The Retreat at Roma Park

Living up to its name, The Retreat offers a getaway from the hustle and bustle of Lusaka city. The family-friendly restaurant is located in Roma Park and serves a wide range of local and international dishes.